On 6 February 2026, the Reserve Bank released the results of the Order Books, Inventories and Capacity Utilisation Survey (OBICUS) for the manufacturing sector in Q2:2025-26.

The data presents a nuanced picture, suggesting a subtle cooling of momentum despite steady headline figures. While aggregate Capacity Utilisation (CU) increased marginally to 74.3 percent, the Seasonally Adjusted (CU-SA) figure witnessed a notable decline of 100 basis points, softening to 74.8 percent.

This divergence suggests that the perceived ‘robustness’ of the second quarter may require a more cautious interpretation. After adjusting for predictable seasonal peaks and irregular variations, the underlying output trend reflects a deceleration. This indicates that the headline growth in Q2 may not stem from new structural demand, but rather from a period of statistical normalization.

Essentially, the performance in Q2 appears to be a ‘catch-up’ phase, accounting for delayed production or previously unaccounted-for growth that failed to materialize in Q1 due to transitory interruptions.

Rather than representing a new expansionary push, the current data points toward the clearing of backlogs as factories recalibrate after a sluggish start to the fiscal year.

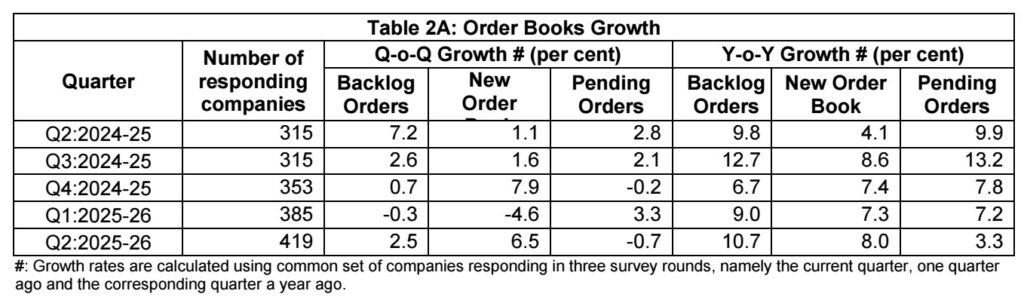

Source: RBI OBICUS Report. Note the sharp Q-o-Q reversal in ‘New Order Book’ growth from a contraction in Q1:2025-26 (-4.6%) to a significant surge in Q2:2025-26 (+6.5%), visually supporting the ‘transient recalibration’ or ‘catch-up’ hypothesis.

This ‘normalisation’ theory was supported by the Order Book data, as the 6.5 percent Q-o-Q surge in New Orders effectively mirrors the -4.6 percent contraction from the preceding quarter, indicating a clearing of previous backlogs.

However, the simultaneous decline in Pending Orders and the -5.2 percent Output Gap indicate that manufacturing continues to operate with substantial slack.

While bank credit growth remains strong at 12.8 percent, its deployment looks focussed on sustaining operations and inventory management rather than sparking a fresh cycle of aggressive capacity development.

Consequently, the manufacturing sector appears to be in a phase of statistical normalisation — characterised by the clearing backlogs and maintaining operations — rather than entering a new stage of high-momentum structural expansion.

This implies that the sector is operating well below the threshold required to trigger a decisive new cycle of private capital expenditure (Capex).

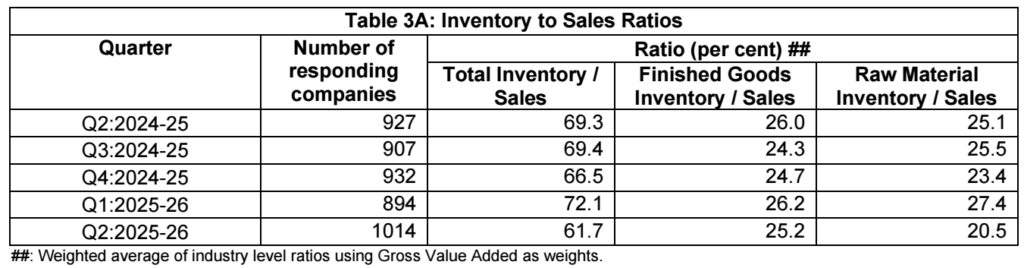

Source:RBI OBICUS Report. Note the sharp rise in the Total Inventory/Sales ratio during Q1:2025-26, which highlights the initial accumulation of slack before the Q2 recalibration.

The inventory data validated the ‘catch-up’ hypothesis, as average sales recoveredfrom a Q1 low of ₹886 crore to ₹1,120 crore.

However, this recovery was accompanied by a significant increase in Finished Goods inventory, which grew by ₹229.4 crore.

This means the production intensity in Q2 outpaced actual market absorption, leading to a build-up of unsold stock.

The increasing inventory-to-sales ratio indicates that the 12.8 percent growth in bank credit is probably being utilised to finance these higher stocking levels. This accumulation of unsold stock, along with the substantial slack in capacity, confirms the idea that the sector is prioritising warehouse replenishment over a true, demand-led increase.

Consequently, the strength shown in the second quarter likely represents a transient recalibration, not a fundamental and enduring breakout.

This discrepancy highlights that while funds and savings are available, they are being used for inventory cycles and not for investment in physical capital for production.

The economy will inevitably confront a growing deficit as long as this considerable capacity surplus remains, preventing available savings from being transformed into the structural investments essential for sustained industrial advancement.